Investing is a key component to building wealth and achieving financial freedom.

But, like many other investors, when I began my investing journey, I lost money.

Why? Well, there’s only two words to describe it.

Fear & Greed.

So, this is for whoever is going through those same problems, and how you can overcome them.

Fear and Greed.

There are dozens of reasons as to why us investors buy and sell assets.

The best way to look at these reasons is to divide them into these two categories:

Emotional reasons.

Non-emotional reasons.

Non-emotional reasons include:

Changing economic outlook. (Inflation / interest rates etc.)

Technical analysis.

Change in disposable income (you have more/less money to invest)

These are decisions made with logic and reasoning.

But, there’s one area which new investors struggle…

Investing based off of emotion.

Investing through fear and greed.

The Psychology Behind Price Action.

Answer this question.

Do you think this chart will go up or down in the future?

Nobody knows where investment prices are headed.

Considering that there’s more green than red in this scenario, most of you might’ve assumed that this will continue to rise.

The truth? Nobody knows.

But what we do know is that if something has historically performed well, we always assume it’ll continue to do so.

When prices rise, we expect them to continue to rise.

When prices fall, we also expect them to continue to fall.

It’s basic human psychology. It’s the reason why so many new investors will end up losing money in the beginning of their investing journey.

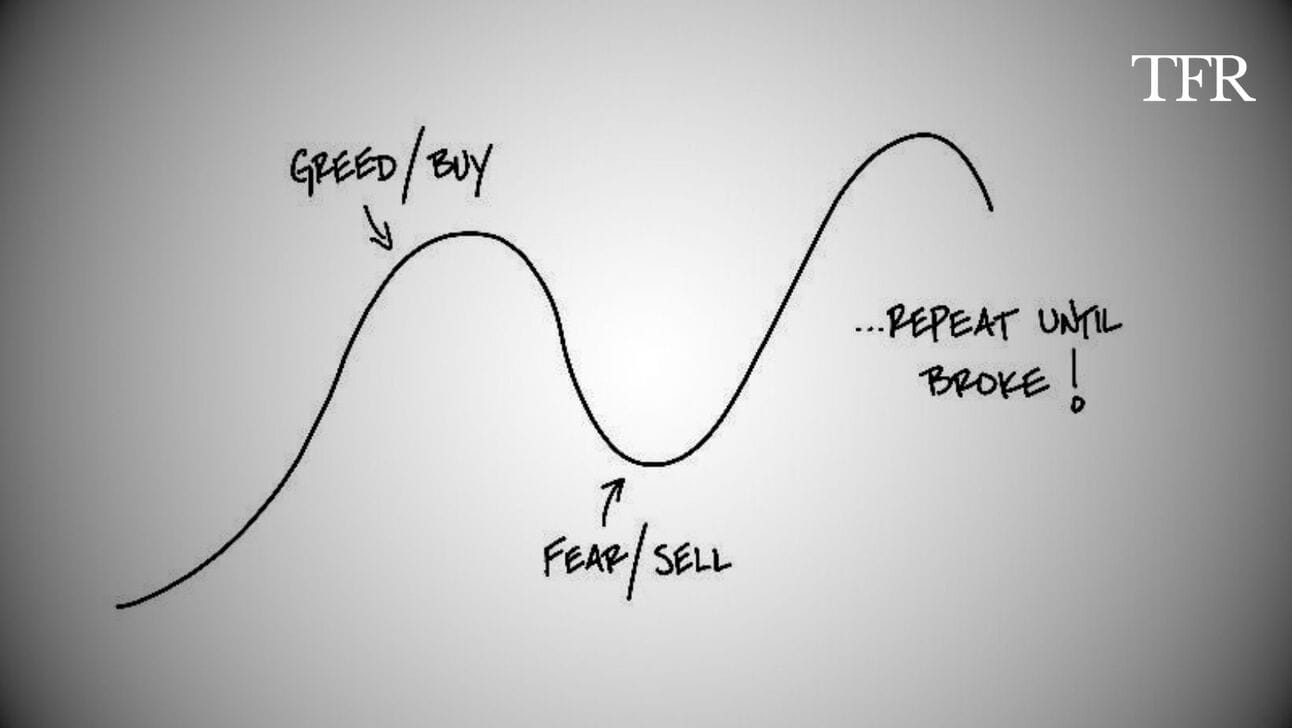

You buy at the top, because you expect it to continue to go up. Greed.

You sell at the bottom, because you expect it to continue to go down. Fear.

It’s imperative than you, as an investor, get out of these habits as soon as you can.

I’ll tell you below how I did it.

Casino Theory

Casino’s are some of the most profitable businesses around.

Only around 14% of casino goers ever walk out with a profit.

Well, if this was the case, why do people still go to casinos with expectations of making money?

It’s for one simple reason.

Casino’s don’t make fortunes off of gamblers because the odds are significantly in their favour.

Casino’s make fortunes because gamblers don’t know when to say they’ve had enough.

Say you and a friend walk into a casino with $100 each. You bet the whole $100 on red (roulette) and you win.

Now you have $200!

Are you going to walk out and call it a day? Of course not.

You just turned $100 into $200 in an instant. Of course you’re going to carry on, and try to do the same again… until the inevitable happens.

Casinos don’t take all your money because they win every bet.

They take all your money because the only time most gamblers stop gambling, is when they’ve got nothing left to gamble with.

In other words, all their money is gone.

Losing all your money is the only signal to go home, and it’s the same with investing.

It’s a valuable thing to learn to quit whilst you’re ahead, before you lose everything.

Mastering Fear and Greed.

The majority of mastering fear and greed comes through your own personal experience.

But, there are a few ways that can help coming from someone who’s been there before.

Think Long Term.

It’s always the cliche tip, but it’s true.

If one of your beloved investments is taking a tumble, remember why you invested in the first place, and remember your overall goal for investing.

Will selling after a small dip help you get towards your overall goal?

Or will you compromise yourself by buckling under the pressure of fear?

Opposite Mentality.

If you go with the approach of doing the complete opposite of what everyone else if saying or doing, chances are, you’ll do pretty well with investing.

If there’s a huge amount of fear, this usually means that prices are low, and in the long run, a good place to buy.

If there’s a huge amount of greed, this usually means that prices are high, and in the long run, a bad place to buy, or potentially a good place to sell, depending on your investing strategy.

Know Your Investments Well.

The more knowledge you have of your investments, the better you will be at reacting to price movements.

I still remember the day that Russia invaded the Ukraine, and all my investments tanked.

Was I worried?

Not one bit. If anything, I was eager to invest more.

Why? Because I knew my investments we’re becoming even more undervalued, and there was a greater margin for profit on the horizon.

A large part of fear and greed (especially on the side of fear: panic selling) is to do with not really knowing what you’re investing in, which is a bad move to make.

Do your research, and never invest your money based on other peoples research or opinions.

Dollar Cost Average.

Dollar cost averaging is the only investing strategy I recommend to people.

It involves investing at regular intervals, rather than going “all in” at any given moment.

It takes out a lot of the risks involved with investing, as you’re consistently investing over a long period of time, which means if there’s a dip, you’ll have the disposable income to take advantage of the lower prices.

Don’t make the same mistakes other investors make.

Eliminate the fear and greed of investing, and you’re way more likely to succeed.

Thanks for reading! Be sure to subscribe (it’s free!) for more financial wisdom every week.